- Level Indicators

- Glass Level Gauges

- Float Switches

- Level Switches

- Level Transmitters

- Submersible Pressure Sensors

- Vibrating Level Switches

- Continuous Measurement

- Tubular Level Gauges

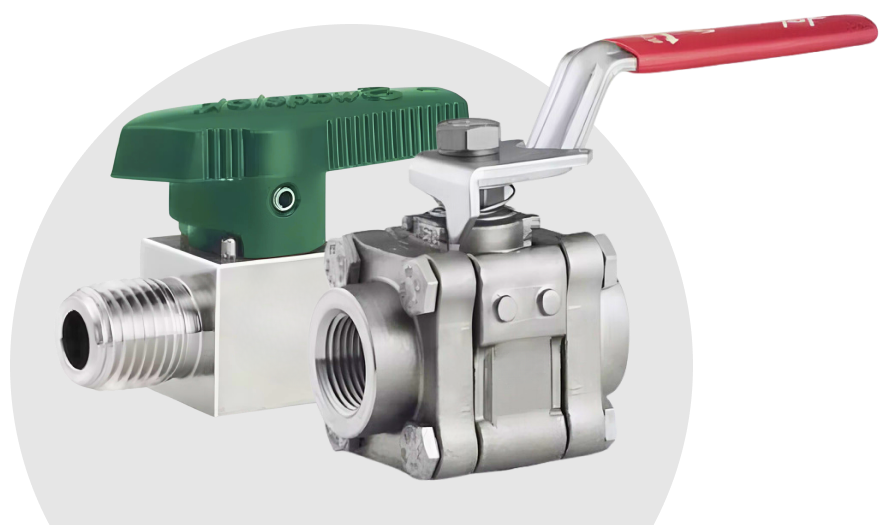

- Accessories for Level Applications

- Engineered Solutions for Level Applications

- Capacitive level sensors

- Optoelectronic switches